You potentially found the perfect home to buy, near the middle of that awesome up-and-coming neighborhood you love so much. You’ve got a good lender to work with you, and you can already smell the lilacs growing in your new backyard!

Except with the way real estate is typically sold, Buyers are making one of the biggest investments of their life without really knowing a lot about the house. Many buyers are completing the home inspection AFTER they’ve made an offer on the house. During the Buyer’s home inspection defects and issues are always discovered and sometimes these repairs or recommendations can not be negotiated in time or at all. A Buyer could, and sometimes do, walk away from the home and potentially have just wasted money on the home inspection, appraisal, well and septic inspection, environmental testing, and so on. If a deal falls through at this point in the game a buyer could easily lose $2-3K!

So, what do you do?

Below is a list of potential deal-breakers that you should be aware of before considering any house your home. It’s best to be aware of these issues before making an offer on the house. Home inspectors will always find at least some issues with a house for sale, and many you can live with. There are several deal-breakers to be on the look out for, some of which may require renegotiating the asking price, requesting the repairs be made before you buy, or even just walking away from the sale entirely.

1. Bad foundation

Minor hairline cracks found in foundations of older homes are common, however large fractures in concrete or basement are a bigger issue. It means the house is moving from its foundation or settling into the ground due to poor soil conditions or potentially improper drainage. Horizontal cracks with bowing found in walls are concerns which can be easily spotted, but some other things to look out for are cracks in upstairs walls, cracks above windows or doors, and doors and windows that don’t shut properly. It is also important to look for moisture staining on walls, floors, and trim as those stains can be signs of foundation leaks.

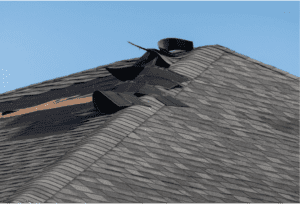

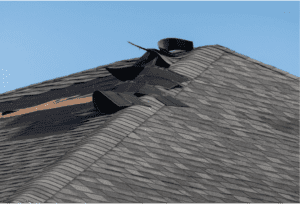

2. Roof issues

A good roof installation can last 25 to 30 years, and a bad roof might need to be replaced right away. While looking at properties be cautious of a roof that noticeably sags or is covered with moss or algae. Also, keep an eye out for shingles that are curling, cracked, or even missing entirely.

3. Wood Destroying Organisms (WDO’s) i.e. termites

Termites and other WDO’s are responsible for billions of dollars worth of property damage every year. Homeowners insurance rarely covers the cost of these issues and repairs. Most likely you will need to hire a Pest Control Pro to eliminate any infestation, at a cost of several thousand dollars. Sometimes this issue may not be a total deal-breaker, but it should prompt a renegotiation the asking price and or other action prior to closing.

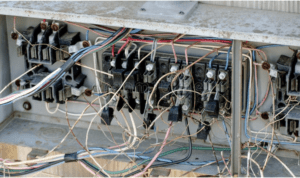

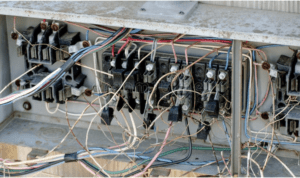

4. Electrical Wiring Issues

These types of issues will require repairs and in some cases a complete replacement of the entire wiring system or electrical panel. There are many types of wiring and electrical problems that should be addressed before signing on the dotted line. Exposed wiring or older fuse style panels and definitely the presence of aluminum wiring, used widely in homes during 60’s. Aluminum expands and contracts with heat, causing connections to loosen and pose a fire risk. And of course watch for knob-and-tube wiring, which is common in homes built before 1930. Certain electrical panels like, Zinsco or Federal Pacific Panels with Stab-Lok breakers are known to be defective as well.

5. Mold

Certain types of mold are toxic and do pose a health hazard. Mold growth occurs when moisture problems such as foundation leaks, plumbing leaks, roof leaks, and increased humidity are present. Look for moisture staining and other areas of staining that could be consistent with mold. If you suspect mold, then absolutely get it tested and confirm its presence. Once mold is confirmed we recommend mold remediation services be performed.

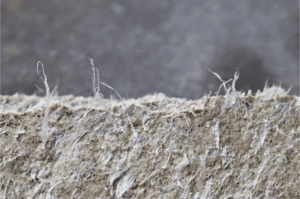

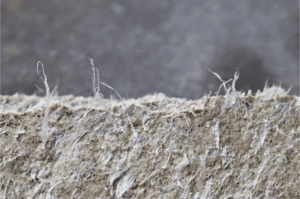

6. Asbestos

Asbestos can be found in types of flooring, insulation and wall coverings. We all know asbestos is bad, however it’s not terribly dangerous and can be easy to fix when it’s contained in the roofing felt or sealant. When to worry? When the home inspector finds crumbling asbestos insulation around pipes. This poses a major health risk and will need to be replaced immediately.

In order to secure better offers on houses Intermountain Inspections’ recommendations for Buyers is listed below:

-

Look for houses which have been Pre-Inspected. Seeing a Pre-Listing Inspection Report will help you make an educated offer on a house vs an uneducated offer.

-

Search for Houses on Inspectedhouses.com to find houses with Pre-Listing Home Inspections. Sometimes you can google the address of a house you are interested in followed with the word “inspection” and the Pre Inspected house will show up on the search page.

-

Hire Intermountain Inspections for a “walk and talk” Pre Offer Inspection. During this type of inspection the home inspector will look at the house with you before you make an offer on the house. These types of inspections will not come with a report, but they will be educational and help you find major problems before making an offer.

-

Educate yourself as much as possible about houses and remember to look for those deal breakers mentioned above.

There’s nothing like moving — whether it’s across town or across the country — to make you realize just how much stuff you have! When moving, you’re likely to let some things go, but probably also add some new appliances, furniture and other items to your list of possessions. That’s why once you’re settled into your new home, it’s an ideal time to create or update your home inventory. Here are the three components of an effective home inventory:

There’s nothing like moving — whether it’s across town or across the country — to make you realize just how much stuff you have! When moving, you’re likely to let some things go, but probably also add some new appliances, furniture and other items to your list of possessions. That’s why once you’re settled into your new home, it’s an ideal time to create or update your home inventory. Here are the three components of an effective home inventory:

What are you looking for in your next home? A big yard? A top-rated neighborhood school? A great space for a home office? A short commute to work? The National Association of Realtors surveyed home buyers nationwide on the home features that are most important to them and found that home buying needs and preferences often vary by age.

What are you looking for in your next home? A big yard? A top-rated neighborhood school? A great space for a home office? A short commute to work? The National Association of Realtors surveyed home buyers nationwide on the home features that are most important to them and found that home buying needs and preferences often vary by age.